Some love coupons and leftovers while others prefer fresh fish and aged cheese. The LIFO method will have the opposite effect as FIFO during times of inflation.

Ending Inventory Formula Calculator Excel Template

During times of inflation LIFO leads to a higher.

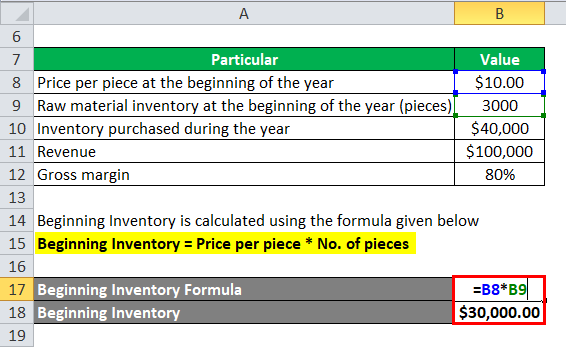

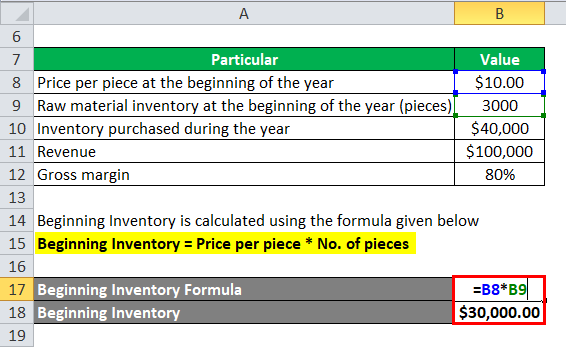

. Changes in inventory levels dont always come from sales. That includes items in your inventory at the start of your year and those acquired during the year. You should calculate the closing inventory figure before you process the adjustment.

Inventory is not an income statement account. It would directly improve the ratio which is valid at that point and not the rest of. When prices are rising goods with higher costs are sold first and closing inventory is lower.

Left to Get 50. To calculate cost of goods sold you have to determine your beginning inventory meaning your merchandise including raw materials and supplies for instance at the beginning of your accounting period. There are two ways to calculate weeks of inventory on hand.

Why Does Inventory Get Reported on Some Income Statements. To avoid the situation of non-availability of ratios one uses the debtors and receivable closing balances but this practice would have serious questions on the correctness of the ratio. This leaves with you a little more stock which is unsold.

Closing Stock FIFO 15 Kgs Rs. Opening direct material inventory is the stock of raw material at the beginning of an accounting period. Cost of Goods Sold COGS Beginning Inventory Purchases Closing Inventory.

One way to calculate weeks of inventory on hand is to divide the average inventory for the accounting period by the cost of goods sold for the same period and multiply by 52. Heres how calculating the cost of goods sold would work in this simple example. Average inventory is calculated using the below formula.

For example 300 1200 1500. They typically total 2 to 7 of a homes purchase price. This results in a decreasing net income.

However the change in inventory is a component in the calculation of the Cost of Goods Sold. Closing costs are fees that lenders charge a borrower or home buyer to acquire a mortgage loan. Choosing the right inventory valuation method can have a significant impact on the profitability of your business.

As the name suggests it is calculated by arriving an average of stock at the beginning and end of the period. Using the above if inventory costing 10000 is expected to sell for 5000 you would reduce closing inventory to 45000 5000 40000. How To calculate PEG Ratio.

Of course every family is different. If this is your first time calculating ending inventory. Ending inventory from prior financial period.

Closing inventory items are considered to be part of opening inventory from the same year. The COGS on your second order is 6 because the next unit you bought was Y. Suppose the debtors decrease at the end of the financial year due to some seasonal business effect.

The first step to calculate your capital gains is to work out your cost basis which is what you paid for the asset plus any brokerage fees. Here we have discussed how to calculate Correlation along with practical examples. The cost of goods sold.

Article Link to be Hyperlinked For eg. The closing price represents the most up-to-date valuation of a security until trading. At its most basic the ending inventory is the materials left.

Buy Now Save Now 50 Off for 4 Months Claim Offer. We also provide a Correlation calculator with a downloadable excel template. Opening stock Closing stock 2.

Average inventory is an estimated amount of inventory that a business has on hand over a longer period. As a business you need to keep sufficient stock to aid in future sale or consumption. You may also look at the following articles to learn more Guide Portfolio Variance Formula.

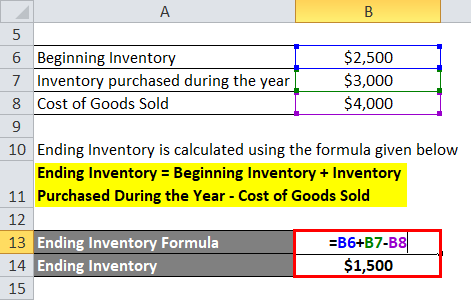

Inventory is an asset and its ending balance is reported in the current asset section of a companys balance sheet. Calculating the Ending Inventory. Add the ending inventory to the COGS.

The closing price is the final price at which a security is traded on a given trading day. Input your family size and details below to calculate how much a nutritious grocery budget should cost you. The method which company decides to use for pricing its closing stock will have a huge impact on its balance sheet Balance Sheet A balance sheet is one of the financial statements of a company that presents the shareholders equity liabilities and.

If your asset is jewelry or furniture be sure to keep receipts of sale so you know the sales price. Formula to calculate average inventory. Cost of Direct Material Used Opening Direct Material Inventory Direct Material Purchased Closing Direct Material Inventory.

Closing Stock Formula Ending Opening Stock Purchases Cost of Goods Sold. How to Calculate Raw Material Inventory. Sometimes its necessary to modify inventory levels to reflect changes in your actual inventory count that might not be in your records.

1500 - 800 700. Calculating Weeks of Inventory. In other words your ending inventory from Q3 is your beginning inventory in Q4.

Inventory adjustment refers to adjustment entries made in periodic accounting to account for differences between recorded and actual inventory items. Read more about inventory valuation and why its important. They yield the same results so you can use whichever is more convenient.

15000 Rs225000- Valuation Variance Rs. The computation of raw materials varies on the basis of their nature and type such as direct materials and indirect materials. 18750- Under this approach system will identify the material movements inout within the period based on assigned Movement Types Transaction Code OMW4 and calculate the FIFO price as Rs.

This is a guide to Correlation Formula. Using the example above your LIFO COGS for the first order would be 550 because you bought unit Z last. The raw materials are generally recorded with a debit treatment to the asset account for the inventory and credit treatment in the liabilities account for the account payable.

To find out your assets selling price check the order of execution confirmation from when you sold the stocks. This portion of stock is called closing stock. Free - Google Play.

At the end of the year after sales you calculate a closing inventory of 10000. Raw material goes through three stages in a manufacturing. Lets deep dive to understand closing stock with example and how should you calculate closing stock.

Top 4 Methods to Calculate Closing Stock. Once youve established your budget use the slider to adjust your estimate to your spending habits. Your accounting records from the prior financial period help you determine where you left off.

Items are assumed to have been sold in order of acquisition. Then add in the new inventory purchased during that period and subtract the ending inventory meaning the inventory leftover at the end for your. You cant just plan not to have a closing stock.

Then work out your. To calculate your new beginning inventory subtract the amount of purchased inventory from this amount. You are free to use this image on your website templates etc Please provide us with an attribution link How to Provide Attribution.

Writing down inventory to net realisable value will increase cost of sales and reduce inventory on the statement of financial position. A Calculating Opening Direct Materials Inventory. Reporting of Inventory on Financial Statements.

Your beginning inventory for the accounting period is 700. Throughout the year you may have incurred 10000 in additional costs to buy and hold more flowers.

Ending Inventory Formula Calculator Excel Template

Gross Profit Method To Determine Ending Inventory Also Called Gross Margin Method Youtube

How To Calculate Ending Inventory The Complete Guide Unleashed Software

0 Comments